The number that a particular credit card carries can only be deemed legitimate or valid if it has been generated with the help of an luhn algorithm, luhn algorithm is an MOD 10 algorithm. The beauty of this algorithm is that it completely nullifies the chance of any errors or accidents from ever taking place. Once the Major Industry Identifier and the Issuer Identification Number are known to the concerned person, in charge of generating the number of your particular credit card, it is quite easy to obtain a random card number that is in accordance with the norms of the aforementioned algorithm.

By using our platform you can generate credit cards from the popular credit card companies Visa, MasterCard, Discover Card, American Express and JCB

CVV stands for Card Verification Value. It is, usually, printed on the back side of a credit or debit card. Normally, it consists of three numeric digits, however, on a credit or debit card that belongs to American Express, it consists of 4 digits. It is a security kink in order to ensure that your card is physically present with you, and no unethical transaction is being set into motion. It is a way to sort of obstruct a fraudulent activity or card theft from taking place, even if temporarily. While entering your CCV online for authentication, make sure that it is hidden by asterisks.

The term, “a valid credit card”, basically, refers to a set of numerical digits, which when placed together and put to test via the MOD 10 algorithm, will be considered foolproof and legitimate. While the algorithm, undoubtedly, does play an integral part in the entire process, please remember that in cases of online transactions, it is not the only thing that is factored into the picture. A whole lot of other things come into the play like, expiration number, the name of the person to whom that card belongs, and, sometimes, even the CVV is necessary to complete the transaction.

The Luhn algorithm is, commonly, known as the MOD 10 or Modulus 10 algorithm. While it may sound quite complicated, it is a little formula to check the validity of different kinds of identification numbers, including credit or debit card numbers as well as social security numbers, to name a few. The algorithm was formulated by Hans Peter Luhn, a scientist at International Business Machines Corporation, sometime in the 1950s. It has gained popularity, ever since its advent in the market, and is in mass use today.

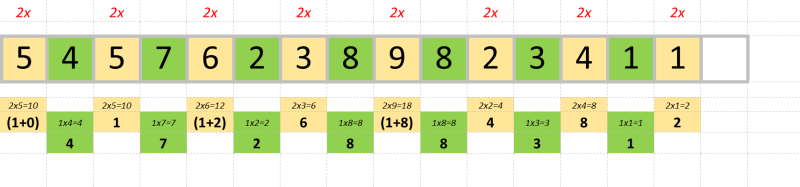

The formula takes into account the check digit and attempts to verify the card number against it. The test, which the card number must clear, is somewhat as follows:

Modern banking has provided us with the opportunity of purchasing items on due and clearing them later. While almost every bank can help you get hold of a credit card, so long as you have an account with them, there are certain qualities that every good credit card should have. First, the credit card number cannot be valid unless it passes the MOD 10 algorithm test. Second, a good bank will assist you in choosing a safe and strong PIN. Last, in order to encourage more commercial trade activities, facilities like low APR and reward points need to be introduced.

It doesn't matter which bank offers the best credit card features. People today go for those companies that offer very less interest than others. You may go check out each bank and ask for their credit card options that best suits your needs.

Credit cards that are generated from GetCreditCardInfo.com are soley for educational purposes only. You cannot buy items using these credit cards. However, these cards are 100% valid and acts like a real credit card complete with fake details such as CVV, name and credit limit.

A credit card is a rectangular piece of plastic that is issued to cardholders by banks. While it may not be money, per se, holders can use it to purchase items and services. The card, then, acts as a promise that the holder will clear his or her dues to the bank, who has paid for them at the moment, at a fixed date along with other applicable charges. Credit cards have an economic advantage in that it increases the rate of transactions in a country, due to the credit facilities, thereby, increasing the productivity levels, which increases the GDP.

Learn more about the parts credit card.

Using it by paying:

After the cashier punched every item you bought and ask for payment, give you credit card and identication. They will swipe your credit card and type the total amount due make sure they type the write amount. They will produce 3 copies of the trasaction made by the terminal one for the merchant copy, the bank copy and your copy the customer. You will ask to sign the merchant and bank copy and get your copy of the slip.

Nope and yes. Credit cards exist to enable holders to buy goods and services, regardless of the amount of money they have with them at present. The money that the shopkeepers or merchants are owed is cleared by the banks. Your card acts as a sort of digital or virtual promise that you will pay the amount back to the bank as well as clear other dues that may have incurred. The card is also a way of leaving a digital footprint of your transaction, to act as a record of sorts. These cards often offer privileges like cashback and reward points.

Very much so. Credit cards have not only been accepted by the monetary institutions and financial governance authorities of every country, but they have also been accepted by international monetary giants like the IMF and World Bank as legitimate substitutes for monetary transactions. When a bank or some monetary institution issues you a card that corresponds to their bank, you are required to sign a contract, stating all the rules on the basis of which your partnership will be formed. This includes a predetermined date of payment, additional charges and EMIs, among others. Read the contract carefully before signing it.